Meet Satellite Technology’s Latest Sector: How Space Tech can be used in Financial Services

While satellites capable of imaging the Earth have been in orbit for decades, the space sector is now undergoing a revolution. Due to advances in manufacturing techniques and innovation in space technology, there is an abundance of satellites imaging the Earth’s surface, providing an increase in Earth Observation [EO] data. Crucially, some of this new data is being provided to users free of charge. The parallel revolution in computer processing power and data science has allowed software to handle and automatically process EO data to extract insights. As costs fall and analytical products and platforms mature, space solutions will increasingly provide the opportunity to tackle numerous global development challenges.

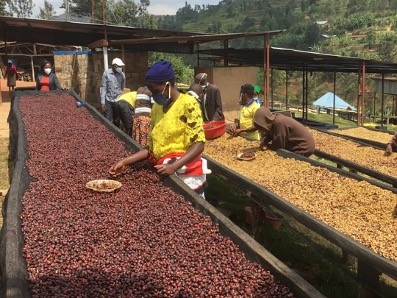

Satellite technology is now frequently used in disaster preparedness and response and in monitoring various environmental conditions such as in forestry and agriculture. While these sectors are more mature in their use of space technology, other sectors are taking note of the potential of the low-cost, high-coverage, repeatable and global nature of EO data in particular and of the capabilities of SatComms. Finance is one of those sectors.

Caribou Space, in partnership with the UKSA International Partnership Programme [IPP] conducted research that explored the current applications of space technology to increase access to affordable financial products to customers in developing countries. Through interviewing organisations at the forefront of developing and providing financial services using space technology the report explores a number of use cases for insurance, credit and payments, including:

- Risk modelling to inform insurance policies

- Insurance and loan portfolio monitoring and risk mitigation

- Design of efficient index-based insurance products

- Remote decision making on verification of insurance claims

- Remote decision-making on credit risk profile

- Satellite communication enabling payments and transactions in remote areas

Through an analysis of these use cases – a number of themes around the use of space technology for financial services are discussed i.e. which sectors, types financial services and business models are dominant.

Lastly the report reflects on what is the impact on both business and financial service users, when space technology is used.

While using Space technology for financial services is comparatively new, it is clear that space technology offers advantages in areas where other sources of information are limited. The analysis presented in this report provide a perspective and a path forward to leveraging space technology in financial services. The future is bright for space technology in the finance sector, and now is the time to seize this opportunity. Access the report here.